In this chapter, we advise on ways of simplifying the news gathering and writing of stories about business and money. We briefly discuss how to cover industrial disputes. We show you how to read a balance sheet. In the following chapter we provide a short glossary of economic terms.

_________________________________________________________

This is an increasingly important field of journalism, and covers such areas as industry and agriculture, commerce, finance and economics - the ways wealth is created and distributed. It is important to readers and listeners, even though they may only be interested in knowing about wage or price rises, house buying or currency exchange rates.

Basic principles

Although at first sight it may seem a very complicated area - full of theories, rules and numbers - you can report it well as long as you remember some simple principles.

Understand the basics

Like any specialist area, there is a basic core of knowledge which you must understand before you can write competently. You do not need to know every aspect of economic theory or possess a degree in business studies, but it is not possible to be a competent journalist without the ability to understand a simple balance sheet or explain profit and loss. Once you understand the basics, you can ask other people to fill in details. Then you can explain what happens in the financial world in a way your readers or listeners can understand.

Report the human face

Because economics is about human actions, it should be possible to tell all economic news stories in human terms. If it is not possible, you must question whether you should really use the story at all.

For example, a story about an increase in import duty should not be written in terms of financial policy, but in terms of what it will mean to your readers or listeners who buy imported goods:

GOOD:

The price of sugar could rise by as much as 20 cents a kilo from next week.

The Government wants to increase the duty on imported refined sugar by 15 percent, to protect local industry. |

BAD:

The Government is to increase the duty on imported sugar by 15 percent.

The increase is an attempt to protect local growers from cheap imported sugar. |

Of course, simplification should not be taken too far. There are some economic issues which affect society as a whole and need serious treatment. It would be an over-simplification to view a plunge in the exchange rate of your currency only as if it will make travellers' cheques more expensive. There would be much greater consequences, both good and bad, such as a rise in the cost of imports and a boost to export industries.

Even these more serious effects should be put in human terms. The travellers' cheques aspect is a very minor side effect. The cost of imported goods on shelves and in showrooms is the right angle.

Give the local angle

Economics is often expressed in terms of cooperation or competition between nations. Economic stories on the major international wire services are usually written from the viewpoint of the major developed nations (and figures are usually quoted in United States Dollars). You have to avoid presenting the issues through the eyes of foreigners.

Your readers or listeners will usually be interested in the economic effect on their own country. Imagine that you are a journalist in Fiji, and have been given a wire service story about a new fishing agreement with New Zealand. While your Fijian audience might be interested in economic stories about New Zealand, they will be more interested in the Fijian side of the deal. So you should research the story with the Fijian government, then write it from the Fijian angle:

GOOD:

Fiji is to be a major partner in an expansion of New Zealand's fishing industry.

The project will be worth $F10 million to Fijian companies and could mean an extra 500 jobs locally.

The World Bank is to give New Zealand US$200 million ($F300 million) to expand etc... |

BAD:

New Zealand is to receive US$200 million dollars from the World Bank to expand its fishing industry.

The money will be used to buy boats and build processing factories in New Zealand and overseas.

Processing plants will be established in Vanuatu, the Solomon Islands and Fiji. Each country will get etc ...

|

Notice how, in this example, we also converted US Dollars (US$) into Fijian Dollars ($F). You must always convert foreign currencies into your country's currency, which your readers or listeners can understand. In some cases you may need to give both the original currency and the conversion in brackets.

Do not overload with numbers

Many economic concepts are quite complicated. You should lead your readers or listeners gently but firmly through your explanation. Your job will not be helped if you scatter numbers through the story like rocks on the path. Your readers or listeners will be held up whenever they stumble over a difficult number.

In the chapters on news writing, we suggested that two or three concepts (ideas) were the most that readers or listeners can handle in each sentence. Each number in an economics story must be regarded as an extra concept because the readers or listeners have to think about it separately before continuing their understanding of the sentence.

Your task is to select only those numbers which are most important (i.e. those which tell the story best) and then spread them throughout the story. Do not pile them like a barrier of rocks across the first paragraph.

GOOD:

Teachers in the Cook Islands will get an average of $10 a week extra from next month.

The rise is the first instalment of an agreement reached in November.

Under the agreement, teachers will get a rise of 15 percent over the next year-and-a-half. |

BAD:

Teachers in the Cook Islands are to get an average of $10 a week extra next month as the first instalment of a 15 percent wage rise spread over 18 months. |

Notice how much simpler the good version was, compared to the bad version which tried to crush four sets of figures into one sentence.

In radio especially, you should never give your audience complicated sums to do during news stories. They will either fail to do them and so miss an important aspect of the story, or they will be so busy doing mental arithmetic that they miss the rest of the bulletin.

You should have the figures in front of you as you write the story. Do the sums before you present the information. Money figures and fractions are usually easier to grasp than percentages. Remember that rounded figures are much easier to understand than long strings of numbers. Almost two thousand is easier to grasp than 1,963.

Instead of saying "wages will be cut by 50 percent", say "wages will be cut in half". Instead of "the price of Gurgles beer is to rise by five percent on June the first", say "Gurgles beer will rise by eight cents a can next month".

Visualise what numbers mean

Whenever you deal in figures, try to visualise what each of the numbers means. This will help you gain a complete picture of the way the finances fit together. See if the numbers make sense by working them out into meaningful units. Spending $500,000 to build 120 houses may sound OK, but divide 500,000 by 120 and you have an average of just over $4,000 per house. Is that a likely price for a house? If we are talking about simple village houses, then perhaps it is; if we are talking about big fancy town houses, then it may not be. Perhaps someone has missed out or added a zero when typing the figures. One zero missed can mean a ten-fold increase or decrease.

Visualising the figures also helps you question people's claims. In our housing example, the politician who offers to spend $500,000 on public housing may seem to be promising a lot (half-a-million dollars!), but if each house costs $40,000 to build, he'll only build 12 houses.

Avoid jargon

The world of commerce and economics, like politics and science, is full of specialist words we call jargon. These are phrases which mean a lot to those who use them every day. They do not, however, help your readers or listeners to understand what can already be complicated ideas (see Chapter 11: Language & style - words).

Sometimes jargon is too long and can be easily shortened - "a medium of exchange" becomes "money". Sometimes jargon is a shorthand for a longer concept and needs explaining in more detail - "hot money" becomes "money coming into the country to take advantage of high local interest rates".

If you get jargon in a press release, do not hesitate to go back to the source for an explanation. If you do not understand it, there is a good chance that many of your readers or listeners will also be confused.

^^back to the top

Investigative journalism

Another of the main problems journalists face in reporting the world of commerce is that information may be hard to get. The people who have power over wealth often like to keep their knowledge as secret as they can. This is partly because they do not want competitors to know what they are doing, but also partly because many of them see wealth as a personal thing, not the concern of the rest of society. But if their power over wealth affects other people, particularly your ordinary readers or listeners, you have a duty to let them know what is happening in society. If people are employed or buy goods, they have a right to know what employers, manufacturers and retailers are doing.

If people in the world of commerce are doing things which are illegal or unethical, they should be exposed. Because many people in the financial world bend rules or take advantage of gaps in the law to make quick money, the field of investigative journalism is a rich one.

It is also a varied one. You may not be exposing financial wrongdoing. You may simply want to find out how much money a foreign company has invested in your country. Finding the information you need may be simple or difficult, depending on what you need to know, who you need to get it from and what they may have to hide (if anything).

Finding information

If you want some information about a company, the first place to look is in your own records or newsroom files. There may be previous stories which you can use. If you are investigating a foreign company, some public or college libraries have editions of overseas newspapers, often on microfiche.

You should ask the company itself for information. If they have nothing to hide, they may be willing to help.

However, if you are researching a story which could be critical of the company in any way, they may refuse to give the information you need. Sometimes they will plead the need to keep information from their competitors.

You should also try to get hold of the company's annual report. You may be able to get this direct from the company itself, from a good library or from the embassy or high commission concerned.

Finally, you can ask the Company Registrar's office (it may be called something like the Registrar General or Corporate Affairs Commission in your country). These offices keep records on registered companies and often investigate complaints of misconduct against companies. In some countries, they maintain records for public searches.

Usually all you need to do is go to the Company Registrar's office and ask to see the records of the particular company. You may have to pay a small search fee. You will not be allowed to take any files away, but may be allowed to make photocopies of relevant documents.

You may not be allowed to see all the company's files. Some are kept confidential for legitimate commercial reasons (for example, so that competitors cannot copy their ideas or see their pricing structures). However, with plenty of spare time and by cross-referring to other files, it is possible to construct a very accurate picture of a company's business links and activities from these public records.

You might, for example, want to trace how directors of one company are linked to other companies which are supposed to be competitors. You might find that politicians or public servants are directors of companies which are bidding for public contracts.

If your country has a Freedom of Information Act, you may be able to get copies of a company's records through a government department with which it does business. Unfortunately, many Freedom of Information Acts exclude public examination of commercial documents held by government departments.

Of course, investigative journalism is much more complicated than simply asking to be shown documents (see Chapters 39 to 41 on investigative reporting).

^^back to the top

Reading a balance sheet

Although the world of commerce seems full of documents containing figures, there is one kind of document which is at the heart of all business. It is called a balance sheet. As the name suggests, it shows how any organisation which deals in money balances the money coming in with the money going out. If more comes in than goes out, the organisation makes a profit; if more goes out than comes in, it makes a loss. If the loss is big enough, the organisation can die. It is essential, therefore, that you are able to read a balance sheet.

There should be nothing frightening about it. A balance sheet is not usually designed to hide figures, but to explain a mass of figures in a logical way.

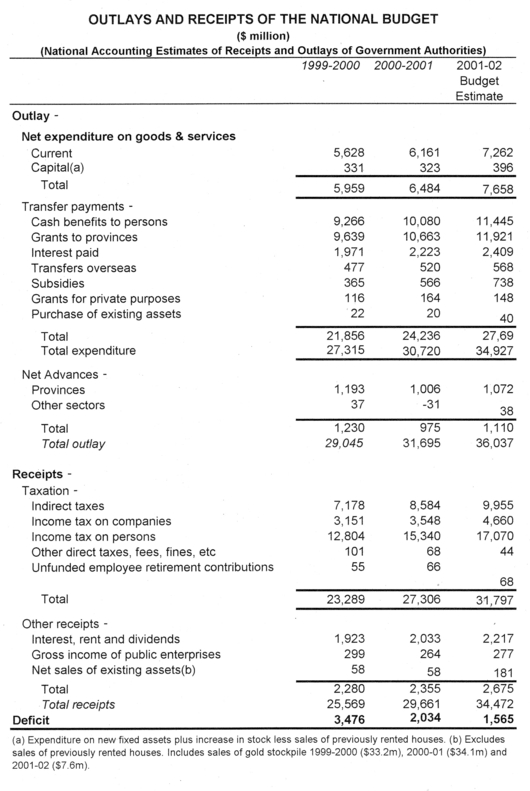

Below we have provided a sample of a balance sheet showing government income and expenditure over three years. Following it there is an outline of how the individual totals relate to each other. Study the balance sheet and the outline until you can understand how all the figures fit together. There are a number of simple steps to follow whenever you are faced with a balance sheet:

- Read the title at the top of the sheet carefully. Make sure that the balance sheet is really what you thought it was. Many journalists have made the mistake of thinking that they were looking at the company's overall balance sheet when, in fact, they were simply looking at a balance sheet of one small aspect (for example, the capital account). There could be several balance sheets in an annual report, showing different aspects of the organisation's finances.

- Note the currency and units in which the figures will be expressed. Glance down at some to make sure you can work out whether the figures are in units of one, tens, hundreds, thousands or millions. There is normally an indication of the multiples used, either at the top of the sheet or at the top of each column.

- Look at the dates showing the periods under review. Simple end-of-year statements will usually have only two dates at the top - this year and last year. Some - like our example - may also have a budget estimate for the following year. Check whether the report periods are for a calendar year or - more usually – a financial year. Calendar years run from 1 January to 31 December. Financial years vary from country to country; in some countries it is the same as the calendar year, in others it may be from 1 July one year to 30 June the following year or from 1 April one year to 31 March the following year. If in doubt, ask someone who knows.

- The easiest way to come to grips with the table itself is first to try to see it as a whole and then break it down into smaller units. First of all, can you find the expenditure and income sections? In old balance sheets, these were put side by side, like the scales on either side of a measuring balance. In modern accounting they follow each other.

- Notice which lines of figures are sub-totals of each section, and which are totals. Do some quick mental arithmetic to check that you understand how all the figures relate to each other.

- Finally look at the bottom line of figures. Does this show the balance is in credit or deficit (profit or loss)? In some cases, the deficit is distinguished from profit by being inside brackets or having a minus sign in front of it. Occasionally on colour documents the negative amounts might printed be in red ink, which is the origin of the phrase “to be in the red” which means to be making a loss or in debt. On company balance sheets, the bottom totals usually balance (hence the term `balance sheet'), with the profit or loss shown as one element of a section higher up the sheet.

The profit/loss line is often the news angle, but you should search around for any unusual aspects. For example, are there any very large figures or any dramatic changes from one year to the next? Don't forget to read any notes at the foot of the balance sheets for explanations.

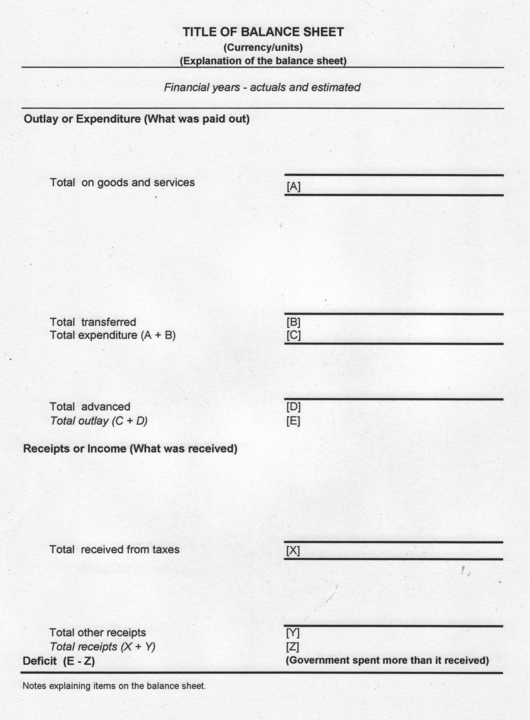

The following is an outline view of the balance sheet above. Take a few minutes to compare the two so you can see what the figures mean and how they relate to each other. While this is a simple form of balance sheet outline, most balance sheets will have similar features, even if they are more complex.

^^back to the top

Unions and employers

The relationships between trade unions and employers play a very important part in the economic life of many countries. It is far too big a subject to discuss in detail here, although one or two facts are worth pointing out.

The first is that you must be fair in dealing with disputes. Unions traditionally exist to represent employees in negotiating with employers, whether these are companies, governments or individuals. In many countries they exist to fight for better wages and other working conditions, while in other countries they may exist only to keep workers informed of what their employers want. In whatever form, they are usually a means of airing complaints.

The essential point is that, wherever one group is arguing against another (such as union against employer) you must be fair to both sides. It is rare for one side in an industrial dispute to be totally right and the other totally wrong. There is usually some right and some wrong on both sides. It is not your job to judge. Simply report the facts, give comments from both sides, and leave your readers or listeners to judge for themselves. (See Chapter 57: Fairness.)

Unions, where they exist, are useful for journalists because they provide identifiable people to comment regularly on industrial matters from the workers' point of view. Most companies or government departments have a boss or a person responsible for speaking to the media. It is more difficult to get comments on the workers' case unless there is an identifiable leader. Union leaders make useful contacts and may give you tip-offs about industrial disputes which the employers want to keep out of the media because of bad publicity. As in all cases of conflict, do not get too close to either side. Just as the company's press officer may try to feed you biased information from one side, so the union leader might try to feed you their propaganda. You will be able to deal with both sides fairly and also serve your readers or listeners if, every time they offer you new information, you ask yourself: "Is this news?"

Remember that unions and employers can both be powerful forces in society. In some countries, unions are affiliated to a Council of Trade Unions or a Trade Union Congress, which tries to agree common policies and co-ordinate industrial action such as strikes or boycotts. Employers also often join together in associations to defend their interests. The major employers' association is often called something like a "Confederation of Industry" or a "Federation of Employers", although at a lower level there may be such bodies as Chambers of Commerce, Chambers of Trade or a particular industrial federation. As with all powerful groups, whether unions or employers, you should not be afraid to report the truth if you work in a free press democracy.

^^back to the top

TO SUMMARISE:

You must understand the basics of economics and finance before you can report effectively

Try to write your stories with a human face, in a way your readers or listeners can easily understand

Do not overload your stories with figures

Avoid economic jargon where possible; if you must include technical terms, always explain them

Balance sheets contain lots of useful information on financial organisations; learn to read a balance sheet

Be fair in reporting industrial conflicts

This is the end of the first part of this two-part section on industry and finance. If you now want to read more about economic terms, follow this link to Chapter 30: Quick guide to economics

^^back to the top